For ten years, international scholars and human rights activists have advocated for solving the Tai Ji Men case. It remains an unresolved injustice.

by Hans Noot*

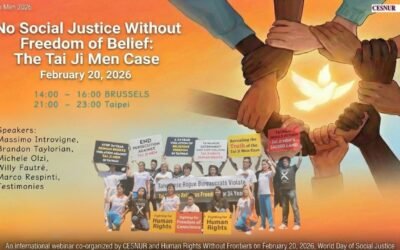

*A paper presented at the webinar “Entering the 30th Year of the Tai Ji Men Human Rights Case,” co-organized by CESNUR and Human Rights Without Frontiers on December 10, 2025, UN Human Rights Day, and in preparation for entering the 30th year of the Tai Ji Men case.

Entering the Tenth Year of Global Advocacy

As we mark the tenth year of international human-rights advocacy on the Tai Ji Men case—on a day commemorating the adoption of the Universal Declaration of Human Rights—it is fitting to reflect not only on what this case has revealed, but also on what remains unresolved. Despite judicial clarity, the denial of due process, fair remedy, and economic justice continues. This persistence calls for reflection and accountability.

From a Resolved Case to an Unresolved Injustice

Although frequently described as a “tax case,” the Tai Ji Men matter reaches far beyond taxation. In 2007, the Supreme Court of Taiwan acquitted Tai Ji Men of all criminal charges. It affirmed that the red-envelope gifts offered by disciples were not taxable income under Taiwan’s law, eventually leading the National Taxation Bureau to correct tax bills for 1991, 1993, 1994, 1995, and 1996 to zero.

Yet—despite this clarity—the 1992 tax bill was left standing, based on an earlier administrative ruling issued before the Supreme Court’s interpretation was available and before the facts were fully adjudicated. This single unresolved year became the legal justification for continued enforcement, culminating in the 2020 seizure and nationalization of land belonging to Tai Ji Men.

This persistence cannot be explained as a clerical anomaly or administrative oversight. When a government continues enforcement based on outdated rulings inconsistent with later judicial findings, the result is not merely procedural contradiction—it becomes a direct violation of the right to due process and fair remedy. Justice, when selectively implemented, ceases to be justice.

Economic Rights: The Often-Ignored Dimension of Human Rights

The Tai Ji Men case also exposes how economic rights underpin all other rights. Continued enforcement has constrained the community’s ability to exercise autonomy, manage its property, and sustain its activities. Analyses submitted to UN-aligned monitoring bodies argue that such actions violate the rights to livelihood and to an adequate standard of living, as articulated in the International Covenant on Economic, Social and Cultural Rights—a covenant to which Taiwan has voluntarily aligned itself.

Economic rights are too often dismissed as secondary. Yet, without security of property and livelihood, communities cannot freely organize, practice their beliefs, educate future generations, or contribute to society. When property is confiscated, and reputations damaged despite legal exoneration, dignity and rights are not only threatened—they are actively eroded.

Taxation as a Tool of Control and Religious Targeting

While this paper focuses on due process and economic justice, one cannot overlook the relationship between fiscal policy and freedom of religion or belief. Scholars have recognized that taxation can function as a strategic mechanism of control over minority belief communities, particularly when overt suppression violates constitutional or international norms.

Significantly, the Tai Ji Men case did not occur in isolation. Historical and legal analyses show that after the 1996 presidential election, Taiwan experienced a wave of what scholars call religious suppression incidents, involving politically-motivated investigations targeting several spiritual and religious communities—including Fo Guang Shan, Chung Tai Shan, Tai Ji Men, the Taiwan Zen Buddhist Association, the Sung Chi-li Miracle Association, and later Guanyin Famen.

Within such a climate, the continued enforcement against Tai Ji Men reflects a broader systemic failure—where taxation evolves from an administrative practice into a tool of influence, control, and silencing.

A Historical Parable: The Roman “Fiscus Judaicus”

History provides a compelling and instructive parallel. After the Roman army destroyed the Second Temple in Jerusalem in 70 CE—a sacred space believed by Jews to be the dwelling place of God, and the center of religious, cultural, and national identity—Emperor Vespasian imposed a new and symbolic fiscal measure: the “Fiscus Judaicus.”

Before the Romans destroyed the temple, Jewish adult males voluntarily contributed a half-shekel offering annually to support the Temple. Under Rome’s new decree, this voluntary spiritual act was transformed into a mandatory imperial tax, redirected to the Temple of Jupiter Capitolinus in Rome—a deliberate inversion of sacred meaning. What had been a religious offering for their own temple now became a humiliating legal obligation imposed on a conquered people to fund an idolatrous temple.

Under Vespasian and especially his successor Domitian, enforcement intensified. Records describe intrusive examinations to verify Jewish identity, including forced public physical inspection of circumcision status—inflicted even upon children, converts, and those merely suspected of “living like Jews.” The tax thus shifted from revenue collection to identity control. Its purpose was to mark, monitor, and marginalize a faith community.

The “Fiscus Judaicus” reminds us that fiscal administration, when weaponized, can become a proxy for religious restriction long before — or even without — explicit prohibition.

A Necessary Conclusion: Aligning Law with Justice

The ongoing enforcement against Tai Ji Men reveals a troubling gap between legal truth and administrative execution—a gap no constitutional democracy committed to human rights can allow to persist. When legal innocence is affirmed, yet penalties continue, when restitution is owed but withheld, and when property is confiscated despite complete acquittal, the rule of law becomes conditional, selective, and fragile.

A judicial ruling does not complete justice—implementation does.

For the Tai Ji Men case, closure must include restoring confiscated property, cancelling illegitimate assessments, and establishing safeguards to ensure that no peaceful community suffers similar treatment again.

Closing Reflection

On Human Rights Day, we are reminded that dignity is indivisible.

A community cannot enjoy freedom of belief while enduring economic punishment.

A legal victory without enforcement is not yet justice. And a state that claims to uphold human rights must ensure that once justice is declared, it is also thoroughly carried out.

Hans Noot is president of the Dutch Gerard Noodt Foundation for Freedom of Religion or Belief (GNF), named after the Dutch legal scholar and champion of religious liberty Gerard Noodt (1647–1725). He is a member of the International Advisory Board of the International Center for Law and Religion Studies (ICLRS) at Brigham Young University, Provo, Utah, and co-organizer of “Breed Overleg Godsdienstvrijheid” (Wider Consultation on Religious Freedom), an initiative with the Dutch Ministry of Foreign Affairs.