Discriminating against traditional organizations through taxes, the government restricts the right to participate in cultural life.

by Bitter Winter

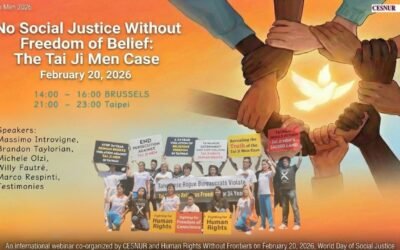

Article 4 of 5. Read article 1, article 2, and article 3.

- Paragraph 298 of the “Implementation of the ICESCR: Fourth National Report” (2025) discusses laws, regulations, and equality measures that protect cultural rights and lists relevant cultural regulations. It states that Taiwan has enacted many important cultural regulations to “provide all people with equal access to cultural resources.” It also mentions that “The Cultural Fundamental Act specifies that people shall not suffer discrimination or be subject to unduly different treatment.” Paragraph 320 states, “The Important Traditional Arts Preservation and Transmission Program was implemented in 2009.” Paragraph 20 of the report submitted under Articles 4 and 5 of the Covenant states that Taiwan has never restricted the rights conferred by this Covenant since it was incorporated into domestic law in 2009. However, the government only lists the legal provisions. It claims that it has not restricted the rights stipulated in the ICESCR. Still, it has not reviewed whether the legal and tax systems, government agencies, or government officials have violated or restricted the people’s fundamental human rights.

- According to Article 15 of the ICESCR and ICESCR General Comment No. 21, regarding cultural rights, the government’s primary duty is to protect its people’s cultural rights by encouraging participation in cultural life and respecting everyone’s rights to engage in their cultural customs. It is essential to take proactive measures to safeguard these rights, including enacting laws and taking other necessary actions to ensure that people’s right to equality, as guaranteed by Article 2, is upheld, and that individuals can freely participate in cultural life without facing discrimination.

- According to General Comment No. 21, paragraph 1, the right to culture is considered universal, indivisible, and interconnected with other human rights. It is essential for protecting human dignity and encouraging positive interactions within diverse societies. The right to participate in cultural life is described as a freedom right, meaning that the State, besides avoiding interference with people’s cultural activities, has a duty to promote and support conditions for cultural participation and to guarantee access to and preservation of cultural resources (paragraph 6).

The Committee observes that culture is a historical, dynamic, and constantly changing process that goes beyond arts and literature. It includes all the ways individuals and groups find meaning in their lives (paragraphs 11 and 13). This covers language, beliefs, traditions, knowledge systems, ways of life, and everyday essentials, all of which are part of culture. Therefore, cultural life involves full self-expression and the shaping of identity.

The realization of cultural rights must be rooted in equality and non-discrimination. Paragraphs 40 and 44 further highlight that protecting cultural diversity is essential to human rights. States must immediately take on responsibilities to ensure the right to cultural life is exercised without discrimination. This includes respecting individuals’ freedom to identify with or change their cultural group, safeguarding freedom of language and thought expression, and removing pressures or policies that enforce assimilation or exclusion based on cultural identity (paragraph 49).

Finally, the Committee clearly states that States must, at a minimum, fulfill “immediately effective core obligations” regarding cultural rights (paragraph 55). These include respecting individuals’ freedom to choose their cultural identities, protecting the right to cultural practice, removing barriers to cultural activities, and creating an environment where individuals or groups can actively participate in cultural life. If government actions prevent cultural groups from maintaining their ways of operating or force them to change, this may amount to discrimination against the group, violating Article 15(1)(a) of the International Covenant on Economic, Social and Cultural Rights. - Given the current situation in Taiwan, government taxation policies still hinder the cultural development rights of non-governmental organizations, and there are instances where tax authorities infringe on traditional cultural organizations’ rights through tax measures.

1. There are too many thresholds and restrictions on tax reductions and exemptions for public welfare cultural organizations.

Article 4, paragraph 1, subparagraph 13 of the Income Tax Act states that only educational, cultural, public welfare, and charitable institutions, or organizations that meet the standards set by the Executive Yuan, qualify for income tax exemption. According to the standards for income tax exemption for educational, public welfare, cultural, and charitable organizations or institutions, these entities must comply with the general provisions of civil law or register or file with the government. Their operations, financial income, and expenditures must meet these standards to qualify for tax exemption. The numerous restrictions and thresholds imposed by the government violate tax neutrality and exclude many non-profit organizations engaged in cultural activities for public welfare or promoting people’s physical, mental, and spiritual health from receiving tax benefits. As a result, similar non-profit organizations face different tax burdens. Additionally, many traditional religious organizations, such as temples, Taoist altars, and ancestral worship associations, encounter difficulties obtaining legal person status and cannot meet the requirements for tax exemption. Despite their long-standing involvement in cultural preservation and public service, these organizations are subject to property tax, land value tax, business tax, and other fiscal burdens due to “lack of registration” or “lack of legal person status,” and they may also face restrictions when applying for subsidies or tax-deductible donations. This systemic exclusion effectively discriminates against the practice of diverse cultural traditions. Therefore, the government has interfered with citizens exercising their cultural and health rights through taxation.

2. Tax officers violated the rights of members of a traditional cultural organization to participate in cultural life through tax measures.

The Tai Ji Men Tax Case

- As mentioned earlier, Tai Ji Men is an organization dedicated to qigong, martial arts, and self-cultivation. It has been promoting Chinese qigong and martial arts culture. Its goal is to showcase the essence of traditional Chinese culture and enhance people’s physical, mental, and spiritual well-being worldwide. It is registered as a member of the Chinese Martial Arts Association, the Chinese Qigong Association, Taipei Martial Arts Association, Taipei Taoism Association, and Chinese Taoism Association. Over the years, the Zhang-men-ren (Grand Master) of Tai Ji Men has led his dizi (disciples) to participate in more than 3,000 cultural performances of qigong and martial arts in Taiwan and worldwide for public welfare. It has been dedicated to cleansing people’s hearts through public activities. It has visited 120 nations to promote a culture of love and peace. Tai Ji Men is not only a cultural organization but also a public welfare and spiritual organization.

- Tai Ji Men disciples admire their Zhang-men-ren’s (Grand Master’s) ideal of peace, follow an ancient etiquette, and establish a master-disciple relationship with him. Following traditional Chinese customs, Tai Ji Men disciples show their respect and gratitude to the Zhang-men-ren by giving him monetary gifts. Observing such a custom aims to carry forward this valued tradition and demonstrates how Tai Ji Men disciples admire their Shifu’s promotion of qigong and martial arts culture. This involves people’s freedom of thought and belief, their right to participate in cultural life, and the specific practices of a cultural organization. However, in the case of Tai Ji Men, the NTB used subjective speculation to treat the master-disciple relationship and the priceless passing down of wisdom and martial arts from the master to his disciples as a business transaction. They misinterpreted the monetary gifts as tuition for a cram school. In Taiwan, no other organizations involved in qigong, martial arts, or self-cultivation have been taxed for receiving monetary gifts from their disciples. The taxation bureau’s unequal treatment of Tai Ji Men shows discrimination by the government’s power. This violates the principle of legality in taxation and established legal norms. More seriously, it infringes upon Article 7 of the Constitution of the Republic of China, which guarantees that all citizens—regardless of gender, religion, ethnicity, class, or political belief—are equal before the law. It also violates Article 18 of the International Covenant on Civil and Political Rights, which supports the equal treatment of freedom of belief and religion.

The NTB misinterpreted the cultural customs and beliefs, failing to acknowledge that Tai Ji Men is a public welfare cultural organization, a nonprofit, and a spiritual organization dedicated to self-cultivation. - In 1997, the taxation bureau violated due process of law by issuing unjustified tax bills to the master of Tai Ji Men for 1991–1996. That same year, the NTB also issued a disposition preventing the master and his wife from disposing of their property. Although the couple had been deprived of property rights and had enough collateral for the alleged back taxes, the Taipei City Revenue Service (a subordinate agency under the NTB) even restricted Dr. Hong from leaving the country in 1998. This action severely violated his freedom to teach spiritual cultivation, preach his messages, and promote Tai Ji Men culture. Such actions discriminated against the master-disciple tradition. The discriminatory taxation carried out by the NTB was entirely against the spirit of the ICCPR and ICESCR. It seriously violated Tai Ji Men Shifu’s and dizi’s rights to participate in cultural life.

Furthermore, because the tax authorities wrongly classified the “tribute to the Grand Master” as tuition fees for a cram school without recognizing it as a gift, Tai Ji Men’s related religious and cultural properties (practice sites) were forcibly auctioned during the final stage of administrative enforcement. This not only violated freedom of religion or belief but also ignored the Taxpayer Rights Protection Act, which requires distinguishing between the fundamental nature and legal status of religious organizations and ordinary for-profit entities. Such indiscriminate enforcement against a religious group led to the loss of religious property, resulting in discrimination and a violation of the principle of equal treatment for religious organizations.

In this case, Article 26 of the Administrative Enforcement Act applied the civil compulsory enforcement regime wholesale to tax enforcement, disregarding the substantial differences in constitutional protections and the cultural importance of religious property. Furthermore, Article 9 of the Act, which does not permit objections on substantive matters, effectively removes avenues for remedy. Consequently, the constitutional guarantees of freedom of religion and cultural rights cannot be upheld, leaving cultural and religious groups without fair and equal review or treatment in tax disputes with the state. This contravenes Article 15 of the International Covenant on Economic, Social and Cultural Rights (ICESCR), which affirms everyone’s right to participate in cultural life, and Article 2, which prohibits discrimination based on identity. Such overly formalistic and excessive tax enforcement measures effectively deprive individuals of their rights to participate in, preserve, and practice their cultural life, amounting to systemic state infringement of cultural rights.

Specific Suggestions:

- Immediately review the tax reduction and exemption regulations and relevant measures for public welfare cultural organizations, and eliminate unnecessary internal regulations (applicable standards for income tax exemption for educational, public welfare, cultural, charitable organizations or institutions) created by the Executive Yuan. Respect the operational choices and cultural transmission methods of these organizations and institutions. The government must not violate tax neutrality or force cultural organizations to change their modes of operation. Furthermore, the government should not mistreat these organizations.

- For public welfare organizations that respect cultural customs without violating public order or good morals, based on the rights to freedom of religion, belief, thought, and expression, as well as their right to choose participation in cultural activities and to freely control their own property, and their right to freedom of contract in private law, the tax authorities must not arbitrarily intervene or evaluate them through criminal or tax measures to hinder their operations. The government should reevaluate the Tai Ji Men case and other similar cases and cease using taxation to infringe on the rights and interests of cultural groups.

- Amend Article 9 of the Administrative Enforcement Act to explicitly include violations of fundamental rights as a valid ground for objection; and amend Article 26 to introduce a “fundamental rights review clause” when applying compulsory enforcement provisions. This clause would require enforcement authorities to thoroughly review cases involving religious, cultural, or other constitutionally protected rights, ensuring that enforcement actions adhere to proportionality and due process principles, thereby preventing unconstitutional enforcement.

- Enhance education and training for public servants—especially those in the judiciary and tax authorities—on this Covenant and other fundamental human rights, making such training routine. Agencies should improve human rights literacy among both frontline and senior staff and develop practical mechanisms for “human rights impact assessments” and “constitutional compliance evaluations of enforcement actions.” These mechanisms should be used in annual performance reviews and promotion decisions, creating an evaluation system for personnel implementing the Two Covenants and ensuring that human rights protection is consistently integrated into daily administrative and judicial practices.