The dysfunctional Taiwanese tax system constantly violates taxpayers’ rights and the Covenant.

by Bitter Winter

Article 2 of 5. Read article 1.

The deficiencies in the Taxpayer Rights Protection Act violate Article 11, which guarantees everyone the right to an adequate standard of living.

I. Paragraph 98 of the Common Core Document, which is part of the reports in the Fourth National Report on the ICCPR and ICESCR, states in the section titled “Domestic Laws Protect Rights Enshrined in the International Covenant on Economic, Social and Cultural Rights” that “The Housing Act, Basic Environment Act, Taxpayer Rights Protection Act, Income Tax Act, Vehicle License Tax Act, Land Tax Act, House Tax Act, and Commodity Tax Act Water Supply Act protect the right of each individual to appropriate living standards for themselves and their family members.” This aims to demonstrate that relevant laws and regulations have been established in Taiwan to protect everyone’s right to an adequate standard of living. Notably, the Taxpayer Rights Protection Act, enacted in 2016 and implemented in 2017, is considered by the Ministry of Finance as an essential milestone in safeguarding taxpayers’ rights.

II. Regarding the legislative purpose of the Taxpayer Rights Protection Act, Article 1 states that protecting constitutional rights related to subsistence, work, property, and other fundamental rights, as well as ensuring the rights of taxpayers, means that the quality of legislation significantly affects the citizens’ fundamental rights. However, does Taiwan’s Taxpayer Rights Protection Act truly safeguard taxpayers’ rights and interests? A review of the regulation contents reveals that many provisions differ considerably from those in the original proposal and stray from the legislative principle of taxpayer protection outlined in Article 1. Since its enactment, critics, including experts, scholars, and NGOs, have argued that the Act prioritizes protecting “tax collection” over protecting “taxpayers.”

1. Article 20: Taxpayer’s Rights Protection Officer

– The Taxpayer Rights Protection Act mimics other countries’ systems by establishing new taxpayer rights protection officer positions. These officers are responsible for helping taxpayers communicate and resolve tax disputes, accepting complaints or petitions, offering improvement suggestions, providing taxpayers’ relief advice, and submitting annual reports on protecting taxpayers’ rights. However, at the practical level, this system fails to fully realize the legislative goal of protecting taxpayers.

– According to the qualifications and guidelines for selecting such officers, the positions are jointly held by tax officials from the NTB and local tax authorities for two years, after which they return to their original agencies. This planning and design led to a situation where the players act as the referees, clearly presenting a moral hazard and a conflict of interest. Imagine: when tax officers who are also taxpayer rights protection officers go back to their original agency after the two-year term. The head of that agency controls their performance evaluation, which goes against human nature. It makes it unlikely that they will remain impartial and independent in protecting taxpayers or questioning the tax bills issued by their colleagues or bosses.

2. Article 18: Tax Court Judges

– Among the administrative litigation cases in Taiwan, most involve tax issues. The tax law and nearly 10,000 interpretive letters or directives are complicated and demand specialized knowledge. Judges in administrative courts are typically transferred from civil and criminal courts and often lack sufficient tax expertise to understand and evaluate the mistakes made by tax authorities. Some scholars have provided empirical data showing that the likelihood of a taxpayer losing a tax case in an administrative court is as high as 90%, leading to the reputation that “these are courts where taxpayers always lose.”

– According to the Taxpayer Rights Protection Act, the tax court shall be made up of judges who have earned the certificate of tax court judges. However, the Legislative Yuan has not clearly defined the standards and procedures for selecting and appointing tax court judges. The guidelines for reviewing applications and issuing the certificates for tax court judges have been issued by the Judicial Yuan (these guidelines were replaced by the requirements for establishing tax courts and issuing certificates after December 28, 2017). The requirements are vague. The review of the first 65 tax court judge applicants followed the criteria in Article 4, paragraph 2 of the review guidelines: applicants who have heard more than 40 tax cases in three years, or the requirements in Article 4, paragraph 10: those who have served as tax court judges and been rated as good judges. Many of these judges were criticized as incompetent in the “courts where taxpayers always lose,” but all applicants received certification as tax court judges.

– In January 2019, the Control Yuan released an investigation report, highlighting that the Judicial Yuan’s review process failed to differentiate between fair and unfair decisions. The report stated that, based on the Judicial Yuan’s statistics about tax case judgments over the past three years by 65 judges, 47 of these judges ruled in favor of government agencies in more than 70% of their cases, and 11 judges ruled in favor of government agencies in over 90% of their cases. All the judges who issued these rulings received certificates, suggesting no screening was ever conducted. This practice violates the Taxpayer Rights Protection Act, which was enacted to safeguard the fundamental rights guaranteed by the Constitution, and contradicts the original purpose of such legislation.

– Although the certificate of a tax court judge must be renewed every three years, Article 7, paragraph 2, of the requirements for establishing tax courts and issuing judges’ certificates, which replace the previous guidelines for review, still allows judges who have heard 40 tax cases within three years to have their certificates renewed. This only considers the quantity of decisions, not their quality. The report from the Control Yuan has implied criticism of the Legislative Yuan’s complacency and the Judicial Yuan’s abuse of power.

(See the Control Yuan Press Release and the Control Yuan Investigation Report).

However, neither the Legislative nor the Judicial Yuan has conducted any review or provided any remedy for this. Clearly, they regard the Taxpayer Rights Protection Act as nonexistent.

3. Article 21: The Statute of Limitations for Tax Audit

– Regarding long-standing tax disputes, it is clearly stated in Article 21, paragraph 4 of the Taxpayer Rights Protection Act that if 15 years have passed and the tax authorities fail to determine the amount of tax after the court withdraws or changes the tax disposition, the tax bill becomes invalid. The tax authorities shall not levy any money for the case. Experts and scholars drafted the original version of this provision, stating that in a tax case, no tax could be levied when eight years had passed since the issuance of the disputed tax bill. However, the final version was changed to specify that, starting from implementing the Taxpayer Rights Protection Act, no tax will be levied in a tax dispute after 15 years after the court revoked a tax bill. While this appears to protect people’s rights and interests, it actually safeguards the state’s right to collect taxes.

– In Taiwan, a tax dispute must first be reviewed by the original tax agency that issued the tax bill. If the dispute remains unresolved, the taxpayer must petition higher-level financial authorities before taking the case to the Administrative Court (judicial body). Although the review and petition process can take years before the case reaches court, those years are not counted toward the 15-year limit.

– The 15-year limit under the Taxpayer Rights Protection Act is three times longer than the five-year audit period, the five-year statute of limitations for tax collection, and the five-year limit for a claim right in public law under Article 131 of the Administrative Procedure Act. Additionally, even the criminal fast trial law states that if the litigation is not completed within eight years, detention will be revoked and the sentence reduced. The statute of limitations for even more serious criminal cases is just eight years. Why does a tax dispute require nearly twice as long?

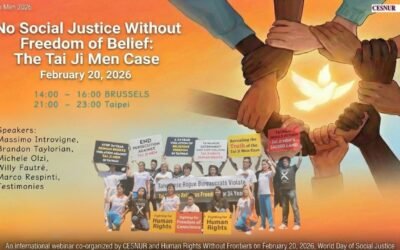

– In the Tai Ji Men tax case (see Appendix 1, article 5 of this series), the tax authorities, without waiting for the criminal court to determine the nature of the income involved, issued a tax bill in 1997 based on the prosecutor’s indictment. In 2007, the criminal court ruling found the defendants not guilty of any charges and not guilty of tax evasion, but the taxation bureau continued to tax Dr. Hong. For its tax case, Tai Ji Men has won 18 times through administrative remedies since 1997. According to the Taxpayer Rights Protection Act, enacted in 2017, after Tai Ji Men won its case in July 2018, it cannot lose its case for the next 15 years. However, the tax agency did not stop trying to collect taxes. Meanwhile, the people have endured injustice for at least 36 years. This clearly violates the intent of a fair trial, as stated in Article 14, paragraph 3, item 3 of the ICCPR, which affirms that everyone shall be entitled to “be tried without undue delay.”

– To solve the “perpetual tax bill” problem, the Judicial Yuan has been pushing draft amendments to the Tax Administrative Case Review Act (hereinafter called the Tax Review Act) since 2024. However, the bill still ignores the burden of proof that should fall on administrative agencies, breaks the principle of proportionality by penalizing citizens for non-cooperation, and does not ensure diversity and independence among tax review officers. It also lacks a human rights perspective in protecting taxpayers’ rights. Additionally, the bill gives administrative courts the power to send cases back to the original disciplinary authority for further legal action. As a result, the proposed amendments still do not fundamentally fix the “perpetual tax bill” issue, raising concerns about the proper direction of the reform.

4. Article 9: Review of Interpretive Letters or Directives

– As mentioned earlier, Taiwan has nearly 10,000 tax interpretive letters or directives, and they have long faced criticism for being excessively numerous, with many outdated and originating from the Martial Law era. These letters seriously violate the “principle of taxation by law” in a country governed by the rule of law. According to Article 9, paragraph 3 of the Taxpayer Rights Protection Act, the competent authority must review whether the interpretive letters or directives violate the law or unjustly increase tax liability every four years. The clause stating that “an external research body can handle this review” deviates from the original proposal by experts and scholars, which specified that interpretive letters or directives “should” be reviewed by an external, independent body every two years. The provision protecting people’s rights has been distorted again.

– How can the Ministry of Finance evaluate interpretive letters or directives issued by financial authorities objectively and professionally? An external, independent body should be required to review them to safeguard human rights. Interpretive letters or directives that infringe on fundamental rights weaken legislative authority and continually violate people’s rights. They should be amended whenever necessary. Why are they only reviewed once every four years? Additionally, many of the nearly 10,000 interpretive letters or directives conflict with current laws or human rights standards. An immediate, comprehensive review is essential, with a report submitted afterward, and making this information public for oversight by the public. Only then can we genuinely uphold the legislative purpose of lawful taxation and protect taxpayers’ fundamental rights.

– Since enacting the Taxpayer Protection Act in 2017, the Ministry of Finance has failed to review interpretive rulings thoroughly. In 2022, the Control Yuan issued a report on the “perpetual tax bill” issue, highlighting that even when people win in court, they often get caught in an endless cycle of litigation, violating Article 16 of the Constitution, which guarantees the right to legal action. This also prevents citizens from obtaining “timely and effective” relief through these rights.

– Regarding interpretive rulings, the report noted that the Ministry of Finance has issued more than 9,000 still-effective tax interpretations. These are numerous, yet they hold substantive regulatory power comparable to tax laws, lacking transparency and failing to create a systematic and coherent normative framework. Additionally, in recent years, the Constitutional Court has declared many tax-related provisions unconstitutional or partially unconstitutional, raising concerns about the legality and constitutionality of current tax laws and regulations.

– The Control Yuan directed the Ministry of Finance to conduct a thorough self-review and swiftly examine and amend these rulings per the Taxpayer Protection Act’s requirements, emphasizing the principle of taxation by law and careful analysis of each tax law’s legislative intent. However, by March 2025, the number of interpretive rulings had only decreased by about 154, with some tax categories increasing. The Ministry of Finance has merely performed superficial, textual, or formal reviews of these rulings. No matter how many review cycles are undertaken, they fail to meet the Taxpayer Protection Act’s standards for examining whether rulings violate legal provisions or intent, or impose tax obligations beyond what the law permits. This approach does not promote a sound tax system nor protect taxpayers’ rights.

III. According to Article 25 of the Universal Declaration of Human Rights and the preamble and Article 11 of the ICESCR, people have the right to a standard of living necessary for their health and well-being, including food, clothing, housing, medical care, and essential social services; the state has the obligation to promote universal respect for and observance of human rights and freedoms. The Taiwan government considers the Taxpayer Rights Protection Act an essential achievement in safeguarding taxpayers’ rights, and it is included in the standard core document of the national report. However, it has been found that the law’s amendments undermine the protection of taxpayers’ rights and do not meet the state’s obligations under Article 11 of the ICESCR.

Specific Suggestions:

The Taxpayer Rights Protection Act should be amended to address the above shortcomings.

I. Taxpayer rights protection officers should be publicly recruited according to the proposal outlined in the Taxpayer Rights Protection Officer Qualification Act drafted by scholars and experts. These officers should be external third-party professionals such as scholars, accountants, and legal experts, and they should exercise their powers independently. To ensure their independence, reference should be made to the United States. In the U.S., taxpayer rights protection officers at the national level should not have served as tax officials for two years before becoming officers or within five years after resigning from their role. A taxpayer rights protection officer should be an independent and impartial third party; therefore, to protect taxpayers’ rights, we should exclude individuals from tax collection agencies.

II. Tax court judges should follow the example of foreign countries that value the qualification of “tax legal practice” (such as the UK and the Czech Republic) or select tax court judges from non-governmental tax lawyers or service groups (like Canada and the Netherlands). Even if a tax court judge is chosen from those who have previously heard tax cases, the review process should focus more on whether the candidate is fair, professional, and committed to protecting human rights. This approach helps evaluate the candidate’s tax expertise and ensures they meet the qualifications necessary to safeguard taxpayers’ human rights.

III. The Statute of Limitations for Tax Audit

In an era where technology widely aids tax collection across various countries, maintaining legal stability in taxation is increasingly important. We should refer to the Tax Collection Act, which states a five-year statute of limitations for collecting taxes, to set standards for prompt tax litigation, and taxation should be based on legal principles. If an administrative decision is overturned by the appeal body or the administrative court, the original tax decision shall also be revoked. Additionally, if the amount of tax owed cannot be determined within eight years of the date the tax collection authority issued the initial tax bill, no further levy shall be made. The goal is to address issues of infringing upon people’s litigation and property rights through “never-ending tax bills” and to ensure the administrative efficiency of tax officials.

IV. Review of Interpretive Letters or Directives

Regarding the laws and regulations that need amending, a thorough review of Taiwan’s nearly ten thousand interpretive letters and directives should be conducted by an independent external body or by scholars with expertise in law and accounting. This ensures that such letters and directives do not exceed the scope of tax law or increase taxpayers’ obligations and liabilities beyond what is legally prescribed. Any interpretive letter or directive that violates the Constitution or conflicts with higher laws should be promptly abolished, with the results made public for oversight. Additionally, the frequency of the two-year review must be specified in the amendment to the law to ensure that the rights and interests of the citizens are protected.