A summary of how the criminal and tax cases were fabricated from the beginning and supported by the lie that Tai Ji Men offered tuition as a cram school.

by Rachel Chiang*

*A paper presented at the conference “Looking at the Development of Human Rights in Taiwan from the February 28 Incident and the White Terror to the Tai Ji Men Case,” hosted by the National Memorial Hall of February 28 and the Taiwan Association for Financial Criminal Law Study, Taipei, ROC, March 5, 2024.

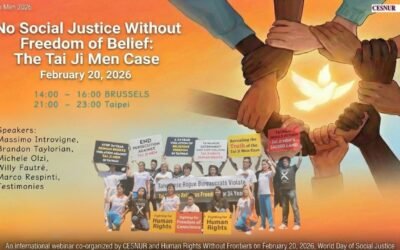

Former Chief Justice Xu Yuxiu once said that criminal prosecution and taxation are the two major pains the country inflicts on its citizens. Italian sociologist Massimo Introvigne mentioned that governments often persecute dissidents through false criminal allegations or ill-founded taxation. In Taiwan, the false Tai Ji Men case known as the “Judicial and Tax 228” is a human rights case where innocents suffered double persecution through criminal prosecution and taxation.

1. The Tai Ji Men case was a false case deliberately created by Prosecutor Hou

A. Taiwan held its first presidential election in 1996. After the election, the ruling authorities began purges. At that time, Prosecutor Hou Kuan-yen used the name of “crackdown on religions functioning as organized crime” to carry out political persecution. Through fabricated witnesses and material evidence created out of thin air, he started the pursuit and persecution against Tai Ji Men, both through criminal and tax law. The Control Yuan took the initiative to investigate Hou Kuan-yen’s illegal actions in his handling of the Tai Ji Men case. The Control Yuan’s 2002 opinion determined that Hou Kuan-yen was involved in eight major violations of law, and the indictment was inconsistent with the evidence materials, which should not have been used as a basis for prosecution. The Control Yuan also requested the Ministry of Justice to take disciplinary action against Hou. With respect to the National Taxation Bureau (NTB) issuing tax bills based on the illegal and false indictment materials handed over by Prosecutor Hou without proper investigation, the Control Yuan also investigated and corrected the tax authorities on September 4, 2009. The Control Yuan listed seven major violations of law by the NTB, including failure to verify and investigate the nature of the income received from the Tai Ji Men dizi (disciples). This proved that the Tai Ji Men was innocent and had no tax debt. It was a false case that was fabricated out of thin air and lingered for twenty-eight years. Moreover, the acquitted defendants who were wrongfully detained were all compensated by the state for their unjust imprisonment in 2009, which further confirmed that the case was a political persecution from the beginning.

B. More than half a century has elapsed since the Tai Ji Men Qigong Academy was established in 1966. The nature of the master-disciple relationship has never changed, and there has never been any issue of taxation, except the six years from 1991 to 1996 when Prosecutor Hou Kuan-Jen fabricated false evidence and built his case. The National Taxation Bureau completely failed to investigate the evidence in accordance with the law and its duties. That is, based on the content of the indictment , Tai Ji Men was regarded as a cram school and hit with illegal taxes and heavy penalties. However, Hou Kuan-yen’s false indictment was judged by the Supreme Court in 2007, which determined that Tai Ji Men was not guilty, had no tax arrears, and had not violated the Tax Collection Act. It also determined that the nature of the monetary contribution dizi gave to their Shifu (Grand Master) was a gift, which is tax free in accordance with Article 4, Paragraph 17 of the Income Tax Law, and that supplying training clothes and other supplies was not a commercial activity and had nothing to do with Shifu and his wife. Hence, there were no tax issues. The activities and evidences for the six years from 1991 to 1996 were the same. Except for 1992, the Supreme Administrative Court ruled in favor of Tai Ji Men for the other five years. In 2019, the Central District Taxation Bureau and the Taipei Taxation Bureau respectively restored the truth based on the Supreme Administrative Court’s 2018 Judgment No. 422 and the Taipei High Administrative Court’s No. 76 Judgment of 2014, and made corrections in accordance with the Taxpayer Rights Protection Act. The tax bills for 1991 and 1993–96 were all corrected to zero, which proves that there is no taxation issue with the Tai Ji Men dizi’s monetary gifts to their Master.

2. Tai Ji Men is not a cram school

The 1992 tax bill is based on the idea that the monetary contributions given from dizi to Master were cram school tuition fees, an idea illegal from the very beginning:

a. Shi Yuesheng, the tax collector who collaborated with Hou Kuan-yen to commit perjury and falsely accused Tai Ji Men of being a cram school, broke his silence before his death. He revealed to the media that Hou Kuan-yen was leading the whole case. Shi was asked to testify at the time of the case, but it was just a trap and a show. It was confirmed that the Tai Ji Men tax case was a fabricated and false case from the beginning, which seriously violated the rule of law. The Taipei Taxation Bureau, the agency responsible for the tax audit, wrote to the Central District Taxation Bureau in 1998 and to the Taipei Investigation Office in 2000, admitting that the content, nature, and amount of the tax bills issued were based on the information and calculations shared by the City Investigation Office. It was obviously a fraudulent process that the Tax Authority relied on these data to issue tax bills against Tai Ji Men without fulfilling their duty of auditing and investigating. This administrative deposition was in fact a material flaw and should be regarded as invalid from the beginning.

b. According to the law, Tai Ji Men cannot be a cram school. The Taiwan Provincial Government’s Department of Education’s 1997 Letter (86 Jiao Wu Zi No. 69135) has clearly stated that according to regulations, it is prohibited to set up cram schools for the teaching of folk skills such as Qigong. Therefore, Tai Ji Men cannot be a cram school according to the law. However, the National Taxation Bureau illegally levied taxes on Tai Ji Men by calling it a cram school.

c. In 2007, the Supreme Court ruled that the Tai Ji Men dizi’s monetary contributions were gifts and had the nature of gifts. In 2012 and 2013, the Taipei and Central District Taxation Bureau’s reexamination decisions determined that Tai Ji Men was not a cram school and recognized that the monetary contributions were gifts. The Supreme Administrative Court’s 2018 Judgment No. 422 determined that Tai Ji Men is a school of Qigong and martial arts. It also confirmed that the National Taxation Bureau leving taxes by considering it a cram school constituted an error in the factual determination and application of the law from the beginning.

d. The comprehensive income tax case concerning the year 1992 was illegally determined because the NTB concealed essential evidence. The administrative court made a wrong judgment for the year 1992 that was completely different from the verdicts about the other years, before the criminal judgment of the Supreme Court determined the nature of the income. Since both the tax penalty and the administrative judgment are seriously illegal, processing the case for enforcement is even more wrongful.

3. The Tai Ji Men case is a major human rights violation

The Tai Ji Men case has not only been listed as a major human rights violation case by the Control Yuan, but also more than 300 legislators, regardless of party affiliation, have criticized the NTB’s illegal activities through joint sign-ups, inquiries, public hearings, mediation meetings, or press conferences. There are hundreds of domestic and international experts and scholars who expressed their righteous support. According to the provisions of the International Covenant on Civil and Political Rights, the state has the obligation to provide effective relief when the citizens’ rights are infringed. Therefore, an incorrect judgment is not an excuse for the tax collection agency not to operate in accordance with the law.

We would like to call on the government to implement transitional justice, urge the Ministry of Finance and the National Taxation Bureau to agree on the nature of the gifts based on evidence, revoke the illegal tax bill in accordance with the law, return Tai Ji Men’s sacred land that was illegally auctioned and confiscated, redress the unjust case, and restore the innocence of Tai Ji Men Shifu and dizi.

Rachel Chiang works as the Chief Attorney at Libertas Law Office in Taipei. She is a Consultant Attorney at the Taipei City Center for Prevention of Domestic Violence and Sexual Assault, and a Director of the First Social Welfare Foundation.